Beware of Bank Impersonation Scams – learn more

-

What are you looking for?

Did you know you can send money overseas from your Qudos Bank account to an overseas bank account via electronic transfer (telegraphic transfer). Qudos Bank has entered into contractual arrangements with Convera to bring you this efficient and economical service.

Benefits of a Telegraphic Transfer:

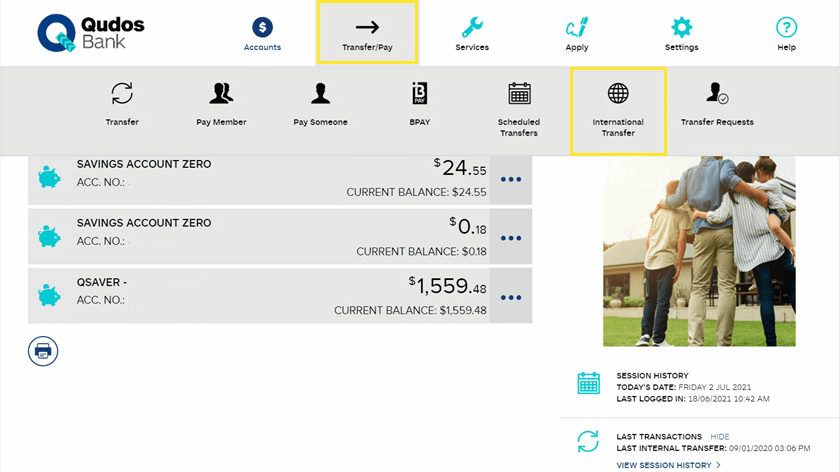

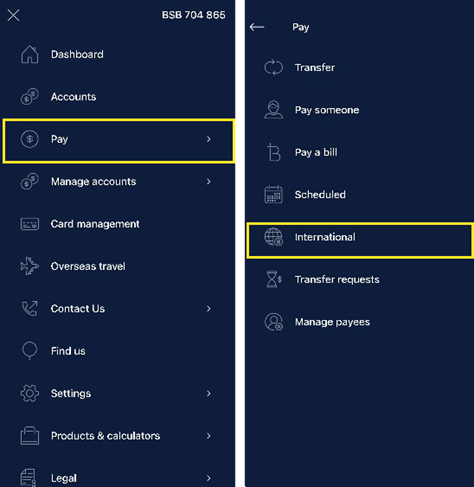

You can arrange a Telegraphic Transfers less than $5,000 yourself through Online Banking, for a fee2.

Select 'International Transfer/Pay' then 'International Transfer' and follow the prompts

Select 'Pay' then 'International' in the menu

We can help you arrange Telegraphic Transfers over $5000 for a fee2. The details of the person you are sending to will be needed before completing the form:

** Further information may be required for some countries**

Download and complete our Telegraphic Transfer Form, you can return the form by:

The funds will usually arrive to the destination bank within 2-3 business days1. Please note some currencies may take longer than others to arrive.

Australia has officially reopened its borders and travel is back on the age...

In this article, we’ll talk you through how to keep your Qantas Points bala...

Earning Qantas Points is easy. Here's how to earn points on day-to-day purc...

The holiday season is coming up and it’s a great opportunity to get away fr...

Whether you live in Alexandria in New South Wales or Mount Isa in Queenslan...

Qudos Mutual Limited trading as Qudos Bank ABN 53 087 650 557 AFSL/Australian Credit Licence 238 305 ("Qudos Bank”) has entered into contractual arrangements with Convera Australia Pty Ltd (ACN 150 129 749; AFSL 404092) trading as Convera (“Convera”), to assist it in fulfilling certain foreign exchange and payment services. The relationship relating to the services described is solely between you and Qudos Bank.

Any advice provided by Qudos Bank is general in nature and does not take into account your personal objectives, financial situation or needs. Because of that, you should, before acting on the advice, consider its appropriateness to your circumstances. Convera does not give you any advice, general, personal or otherwise. Qudos Bank has a revenue share arrangement with Convera, where Qudos Bank receives a percentage of the foreign exchange margin revenue and fee revenue (where applicable) for the relevant foreign exchange or payment service. See Qudos Bank’s Financial Services Guide for more detail. Fees and charges and terms and conditions apply. It is important for you to consider the relevant terms and conditions and Qudos Bank's Financial Services Guide and Fees & Charges brochure before you decide whether or not this financial product is right for you.

1. Funds are usually received by the beneficiary bank within 2 to 3 business days however delays may be experienced with allocation of funds to the beneficiary account by the beneficiary bank. There is no delivery period guarantee. Some currencies may take longer than others to process.

2. For the Transfer Fee please see our Fees & Charges brochure or call us on 1300 747 747 for more details.

^ IBAN is used in some countries to uniquely identify a customer’s bank account. An IBAN is necessary for payments being sent from Australia to an IBAN mandatory country.